Investment Performance

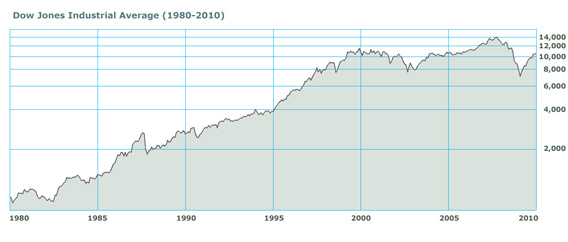

We encourage clients to take a long-term view of investing in the stock market. By this, we do not necessarily mean 10 or 20 years, although in some cases this time period is totally appropriate. But, true investors look beyond any one quarter or any one year, whether good or bad. For example, as bad as the year 2000 was, and it was a dreadful year, it was only the first year since 1990 when all three market indices (DOW, NASDAQ and S&P 500 Index) were down in the same year. Another perspective is the October 1987 crash of the DOW, free-falling 22% in one day, from about 2200 to 1700. This is the equivalent of the DOW falling roughly 2700 points in today's market. In the despair of 1987, few could have envisioned DOW 10,000...but it now stands at about 12,500, over seven times higher than the low of 1700. At Fieldstone Money Management we strongly believe in the stock markets to build wealth over time. And, we are committed to making that happen for all our clients.