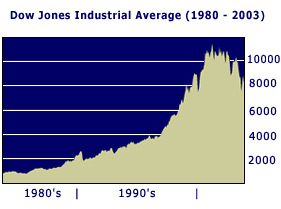

In 1980 the DOW stood at 824.5. Twenty years later the DOW ended the year 2000 at 10786.9, 13.1 times higher. This means that $10,000 invested at the beginning of 1980 grew to almost $131,000, a compound annual growth rate of 13.7%. This occured despite an economic recession in the early 1980's, a major market crash in 1987, a recession and war [Operation Desert Storm ] in the early 1990's, the collapse of the Russian economy and the failing of a major U.S. based hedge fund in the summer of 1998. And, yes even after the terrible tragedy of September 11, 2001 followed by two years of recession which brought the DOW to a low of about 7600 in October 2002 the DOW railied back to close 2003 at 10454, up 38% from that October low. There will always be "bumps in the road". However the stock markets have a long and well documented history of providing double digit annual returns for those investors with patience and a long term perspective. |

We encourage clients to take a long-term view of investing in the stock market. By this, we do not necessarily mean 10 or 20 years, although in some cases this time period is totally appropriate. But, true investors look beyond any one quarter or any one year, whether good or bad. For example, as bad as the year 2000 was, and it was a dreadful year, it was only the first year since 1990 when all three market indices (DOW, NASDAQ and S&P 500 Index) were down in the same year. Another perspective is the October 1987 crash of the DOW, free-falling 22% in one day, from about 2200 to 1700. This is the equivalent of the DOW falling roughly 2400 points in today's market. In the despair of 1987, few could have envisioned DOW 10,000...but it now stands at about 10,800, over six times higher than the low of 1700. At Fieldstone Money Management we strongly believe in the stock markets to build wealth over time. And, we are committed to making that happen for all our clients. |

|||

| ©2004 Fieldstone Money Management, Inc. |

||||